Deep Dive: The Path to PMF

What it looks like in practice

Finding PMF is probably the most difficult AND complex thing you’ll do in your career, by a nontrivial margin. And the current state of startup advice makes it MORE difficult and MORE complex. COOL.

Here is what the path to PMF looks like, in detail. This is a long post, but if you understand this post, you will generally know what matters at any single point in time in your startup.

We spent ~50 minutes discussing this in more detail here:

The Outcome: The Case Study + Factory

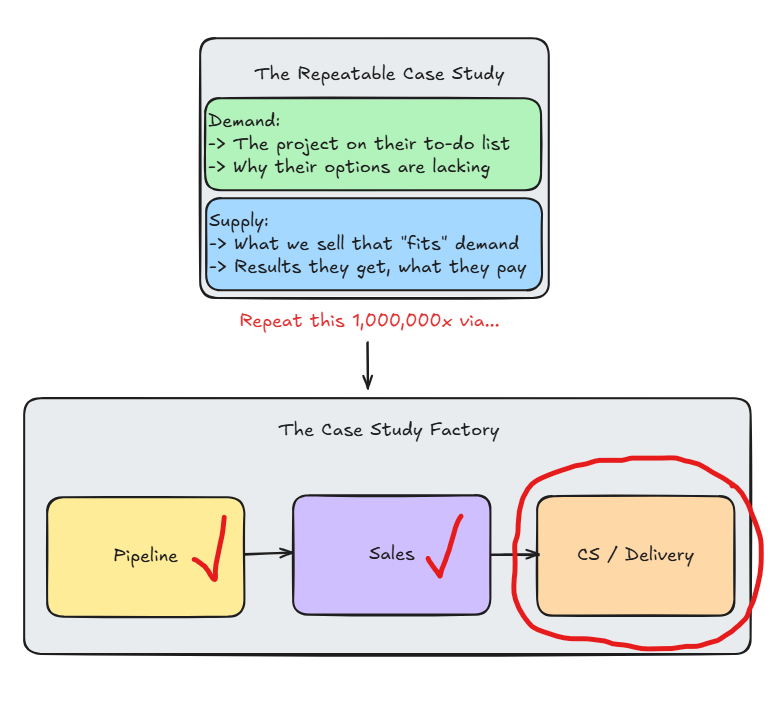

Let’s start at the end: Here is how product-market fit works. It consists of two interconnected things:

The Repeatable Case Study: Who says hell yes to you before and after they buy? What do you sell them? What are they trying to achieve, and why do they buy?

The Case Study Factory: How do you repeat the case study? How do you find potential customers, turn them into actual customers, and turn them into retained customers - and do that at increasingly higher volume and speed?

This is all you need. There is nothing else. These two things generate your website, your product requirements, your sales collateral, etc.

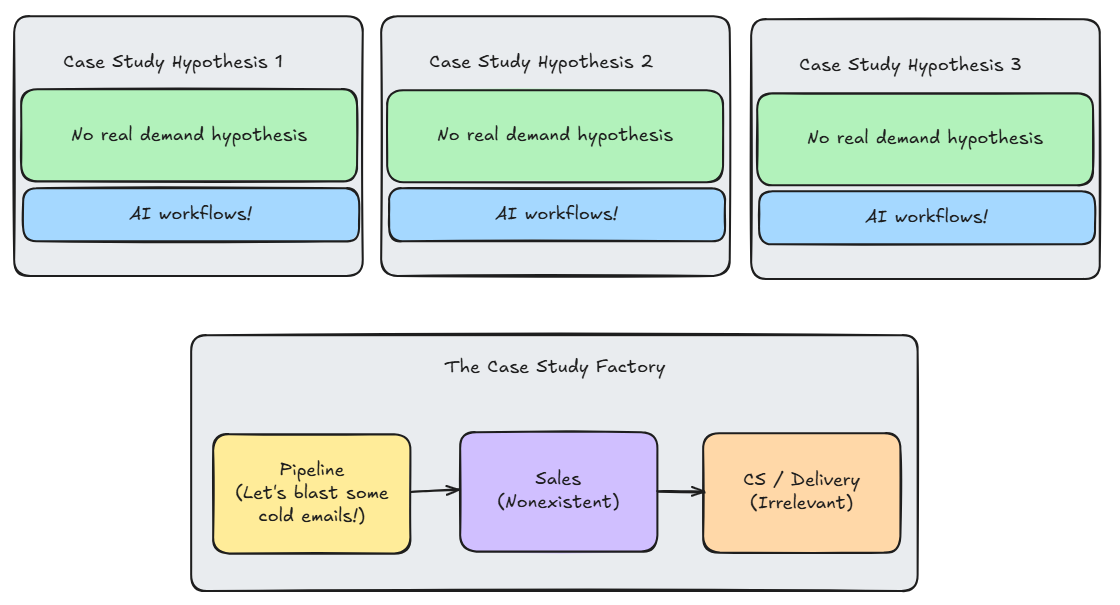

Here’s a simple diagram of the two things:

When you have product-market fit, the case study and factory work. Which means…

You know exactly who needs to buy, when, and why

You have a high win rate

You have a lot of pipeline

You have fast sales cycles

Nearly every single new customer finds success fast, renews, and ideally expands

It feels like customers are pulling themselves through the “factory” (buying → using → renewing), versus you pushing them through the factory.

Our job as founders is to figure out both the case study and factory, and make them work. This is particularly difficult for two reasons:

Each piece of the case study + factory interacts with all other pieces. The messaging you use in your sales process, for example, sets expectations that your product and delivery process has to deliver upon.

Until everything works, nothing works. You can have a bunch of sales conversations, or even a bunch of inbound interest, but unless this is turning into retained customers, you don’t really know if your pipeline system actually works. There are no participation trophies or points for effort; it all works, or nothing does.

So here’s the typical path from “not working” to “working”.

Entering the Pain Cave

Let’s take a hypothetical B2B startup building “horizontal AI workflows” (or AI agents, or whatever). They have a product idea, and a bunch of guesses about who might benefit from their product. Maybe they have a few design partners using their product in vastly different ways.

They look like this:

They had many different paths forward:

Verticalize, and focus on a particular kind of customer. (e.g., orthodontists, cab drivers, solopreneurs)

Stay horizontal, but focus on a particular kind of workflow. (e.g., automating accounts payable, automating production planning, etc.)

Keep pushing on the platform play (e.g., “The n8n alternative that’s better… for some reason”)

On Day 1, they didn’t think they had to choose; they blasted out a bunch of cold emails, got a 0.1% response rate; had a couple very awkward demos; their engineering team struggled to support their vastly different feature-sets for their design partners; life sucked.

They were in the pain cave. They read this newsletter and they said, “Shoot, I wish we’d read this six months ago! And, by the way, I bet this Rob guy can deadlift a lot of weight!”

Damn right he can. Anyway here’s what happened next:

The path out of the pain cave

The team decided that they needed to pick a direction, because picking every direction clearly doesn’t work. But how to pick? Each direction had trade-offs; after a while in the pain cave, they swallowed what was left of their egos and picked one path.

They wound up going where they felt the strongest customer demand. Why? Because they wanted to design around pull, rather than pushing.

After choosing their path, they had a rough sense of their target customer, case study, and how their factory might work. So they re-started their outbound sales approach.

Bottleneck #1: Pipeline

For the first few weeks, they couldn’t get anyone to talk with them. Their cold outbound just wasn’t working; they got maybe one meeting per week. Their bottleneck was pipeline; nothing else mattered unless they could get potential customers to talk with them.

They spent 3 months relentlessly iterating on their pipeline until they got to 1-2 sales calls per day.

Here’s a short list of what they did:

They adjusted their LinkedIn profiles so they seem interesting to potential customers (they see their connection rate go from <10% → 25%)

They tweaked their outbound targeting to focus on people who recently posted on LinkedIn (they see their connection rate go from 24% → 40%)

They changed their messaging to stop trying to sell their product, and instead just got people to talk with them (they see reply rate go from 1% → 10%)

They layered in emailing, calls, and warm intros + personalized outbound

They started posting on LinkedIn 3x / week and got some inbound from that

When personalized 1:1 outbound worked, they hired a virtual assistant to draft 10x/day

They got to 5-10 meetings per week… and earned the next bottleneck.

Bottleneck #2: Sales

Very few of their calls turned into actual live deals. It’s not clear why this was the case; most calls felt like they went well… Now that they were getting 5-10 meetings per week, their bottleneck had shifted, and was now the sales process. If they didn’t solve the sales process, nothing else mattered.

But they quickly learned that “solving” the sales process is about much more than the sales process.

They spent 4 months iterating on a bunch of things that impact their sales process:

Case Study iterations:

After ~40 calls, they realized that their understanding of demand was wrong. They had the wrong buyer in the organization, and the wrong “project” on that person’s to-do list. As a result, they were getting a lot of head-nods but not a lot of pull. So they rewrote their case study.

This realization emerged when they looked across the 40 calls at the 2 people who actually had demand; they compared and contrasted with those who DIDN’T have demand.

Pipeline iterations:

As it became clear who had a real project on their to-do list, they had to change their outbound targeting.

Changing their targeting broke their pipeline system - which went from 10 meetings per week down to 3 - so pipeline became the bottleneck again, and they debugged it (fortunately, faster than before).

Sales process iterations:

They restructured their discovery questions, because originally they were learning interesting but irrelevant things.

They were also demoing too much, too soon, so they changed their call script and only did a 30-second demo in Call 1.

They didn’t have a clear plan for Call 2, and weren’t scheduling Call 2 during Call 1, so they had a lot of drop-off from Call 1 to Call 2 and weren’t sure why.

Their group demos were an unnecessary bloodbath, because they were unintentionally threatening someone’s job, so they had to fix that.

They found a way to make their trial/pilot/offer a “no brainer” that buyers would pull… after a few people dropped off who seemed like they were so close to buying.

Downstream iterations:

Based on what they learned about demand and why people actually bought, they realized they needed to hide a lot of the product’s functionality.

By the end of this 4 months, their sales process started to take real shape, and buyers were starting to convert. MRR is going up!!! PMF, right? No? Ugh…

Bottleneck #3: Delivery

Turns out, it’s shockingly difficult to get customers onboarded and successful so they don’t churn, even when they have demand! We only really learn this when we start consistently closing customers; sometimes, we don’t see the problem until annual contracts come up for renewal (at which point, we are in ROUGH shape… trust me!)

This AI workflows startup was starting to consistently close customers… but they weren’t using the product yet… which means they earned the delivery bottleneck; if they didn’t solve this, nothing else mattered.

They spent 6 months maniacally fixing their delivery bottleneck, which, as it turns out, is about a lot more than onboarding and product.

What they did:

Delivery:

Figured out what caused customers to be successful, or not. This was the hardest thing that unlocked everything else. They figured this out by observing their most successful customers, and comparing/contrasting those versus others. They realized that it was a combination of two things:

The buyer had to be a particular KIND of buyer, in a particular KIND of situation, with a particular KIND of demand

The buyer had to accomplish three specific things with the product to get to the “aha” moment, the point where they would be weird to churn.

They changed their onboarding process a few times, because there was drop-off. Part of their onboarding process is now a scheduled 1:1 onboarding meeting, rather than just sending over the signup link.

They also changed the content of their 1:1 onboarding meeting, so that buyers hit the “aha” moment in the onboarding meeting and would be weird to churn. In other words, they created a bullet train to customer retention.

This led to them iterating on the product too, of course! The product’s onboarding experience and user experience took clear shape based on what caused customers to find value and renew.

Case Study:

They had to do another iteration on their case study, redesigning it not just based on who would buy, but those who would find success and renew.

Pipeline:

Once again, their pipeline broke as they changed their targeting based on their new-and-improved case study.

Sales:

They sharpened their discovery questions and sales process to focus exclusively on who would be most successful post-sale

They changed their pricing model again

They compressed their sales process too, going from an average of 3-4 meetings over a 2-month sales cycle down to 2 meetings over a 1-month sales cycle. They were able to do this because they finally understood their case study, and felt they weren’t missing anything.

At this point, they had spent about a year iterating on their case study and factory, and finally understood the physics of both. They felt customer pull throughout the process. Their next tasks were to:

Hire sales and CS reps who could run a proven playbook

Automate pieces of the sales and delivery process

Find one scalable, cost-effective pipeline source and start growing super fast

End story.

Implications

This is the path: You first spend some time wandering about in the pain cave, then you find a hint of pull, and then you spend another chunk of time relentlessly iterating on your case study and factory until you’re growing consistently.

So what?

My takeaways:

This is why it’s basically impossible to “test” multiple ideas at once. It takes a heroic amount of effort and attention to make any one thing work; try two, and you’re guaranteed to fail.

This is why you need to get going ASAP. Assume that it will take you 12-18+ months to get anywhere meaningful. And the clock doesn’t start when you raise money, or when you start doing discovery interviews - it starts when you decide to start “figuring out sales.” Which means: Stop going to pitch competitions and random startup conferences. You have less time than you think.

Each bottleneck is fatal by default. Without your entire focus and attention on each sequential bottleneck, you’re guaranteed to die. Treat each bottleneck like it’s life-or-death, because it is. The bottleneck is generally pretty obvious, but the path out of it often isn’t. And endless shiny objects conspire to prevent you from fixing your bottleneck.

This is why you can’t hire for this - and why people with post-PMF experience struggle a ton pre-PMF. It’s not just that it’s difficult, it’s that you have to be able to SEE the case study and factory in your mind. There’s a reason most sales coaches won’t touch pre-PMF startups with a 10-foot pole: Their expertise is for the stage when the case study and factory are mostly working, and just need to scale.

This is why demand matters. Demand is what causes buyers to pull themselves through our (barely-functional) case study factory, rather than us needing to push them through the factory and, for example, try to manufacture urgency or run the “perfect” sales process. The stronger the demand, the faster we grow for any given ounce of effort, and the less perfect our factory needs to be.

This is FASCINATING. A lot of founders look at sales and say “gross”, or “easy”, or “that’s beneath me.” Wrong in all cases. You have the opportunity to craft a factory from nothing, and know how each piece connects with the others. This will teach you more than HBS or McKinsey ever could.

So yeah, that’s the path. Wish someone had written this down for me a decade ago.

PS: Working with my next batch of startups on in late July / early Aug - more HERE. I’ll watch your sales calls, review your metrics, fix your case study etc. so you can waste the least amount of your time (and sanity) on your PMF journey.

As a tech founder still working toward that first million, this deepdive is incredibly valuable. Really appreciate you sharing this, Rob!

Great stuff here thanks. I have heard a lot of "do they have pain", I haven't heard "do they have demand", that is an interesting nuance I want to dig into more.