Do you have a demand problem?

The demand audit

Have you subscribed to the Physics of Startups podcast/YouTube yet? It’s the companion to this newsletter, where we dig super deep so you can apply stuff to your startup. Here’s the link to this newsletter’s episode:

https://spotify.link/qHY1vNutxXb

“COOL ROB. I get this demand thing, I get why it matters… but I am NOT feeling it. Demand feels lukewarm at best. What do I do now?”

First: You’re not alone. Startups can slog for years without finding intense, repeatable demand. Sales is slow and frustrating; retention requires heroics. You can, of course, build a profitable company that never taps into intense demand… but it’s an exhausting push every step of the way.

To avoid unnecessary slogging I suggest running a demand audit. The purpose of a demand audit is to figure out if there is intense demand anywhere in your universe - and if so, where is it, what is it, and what do you need to do in order to unfold towards it?

In this post, I explain how to run a demand audit. I have done these with startups at the idea stage all the way up to $20M+ ARR. Even if you’re growing, if you want to grow faster, it’s worth doing a demand audit.

I use this approach to help startups find intense demand and repeatability - and also to analyze individual deals. It’s the same methodology; you’re just looking for demand in a customer’s words and actions.

Demand audits are - if you’re following along in my “physics of startups” Miro - part of the sales sprint approach to testing a PULL hypothesis:

The demand audit

What you’re looking for: Signals of where potential customers are applying force against their status quo, but don’t have good options. You’ll turn these signals into the PULL framework: What is the project on their to-do list, why is it their top priority, what options do they consider, and why aren’t these options good enough?

Why you’re looking for this: If you don’t design around this force, you’ll trudge along, pushing and persuading customers to buy and renew. If you do design around this force, customers will use the force they’re already exerting against their status quo to purchase and adopt your product. These people buy and renew with little convincing.

Where to find this: Your customer conversations! (Ideally you have recorded sales, discovery, and customer success calls.)

What good evidence of demand looks like:

One customer buys weirdly fast

A prospective customer ghosts, then reappears months later and buys fast! (What changed?)

One potential customer really leans in during a call - “Wait, you can help me with X?!” (Even if they eventually lean out and don’t buy)

One potential customer says, “No I’m not focused on X, what I’m really focused on is Y!”

Someone says, “Oh yeah we bought your competitor’s product already, it’s not ideal but honestly good enough, we bought it when XYZ happened.”

What bad evidence of demand looks like:

People expressing future aspirations, or talking about “where the industry is headed”

People complaining about their problems or pain points without expressing the force they’re trying to apply to solve these things

People talking about what their company should do / is prioritizing - not what they individually are prioritizing.

These are not demand. They seem like demand, but remember, demand is an individual buyer applying force against their status quo - not a buyer complaining about a generic company problem they’re not going to put in effort to do anything about.

How to organize your demand audit: In a spreadsheet, doc, or Miro board, make a list of your calls and include verbatim quotes and timestamps of where you think they were expressing demand and pushing against their status quo. (It often helps to have someone sanity-check you, whether that’s me or a fellow founder!)

Below is an example of a demand audit I ran for my startup Waffle. I analyzed 10 sales calls across these dimensions:

Did they have demand, and if so, what was it?

Did our supply fit; why or why not?

Did they pull for next steps?

So what?

What you might find in a demand audit

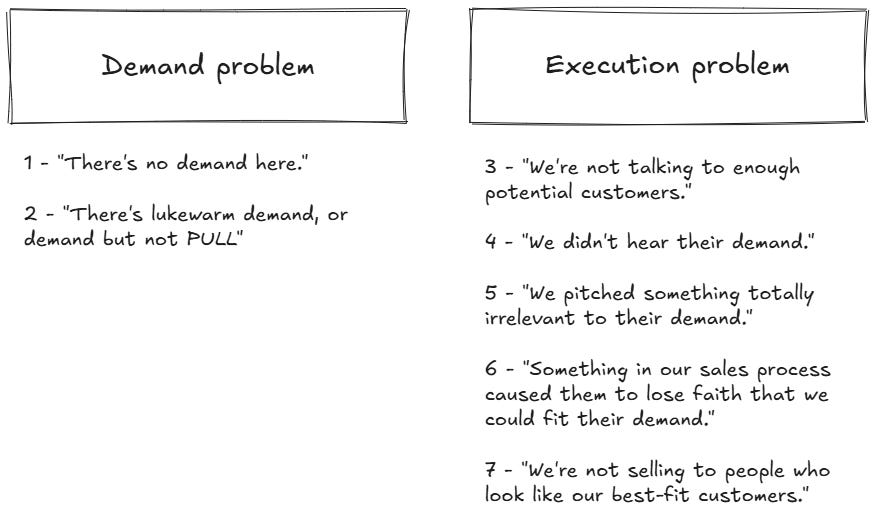

Sometimes a demand audit surfaces a demand problem, but often it surfaces execution problems that AREN’T demand problems. Here are seven patterns I’ve seen in demand audits:

Demand Problems

1 - “There’s no demand here”

Any serious exploration of your customer conversations will uncover that much of what you thought was demand was actually not demand. Instead, it was random mouth-movements of enthusiasm or complaint.

You’ll find, for example, quotes like, “Yes, this is a serious, stated problem for the company right now!” This sounds like demand, but it misses the two actual ingredients of demand:

Force - that it is a priority we are actively applying force against, rather than a static problem we’re doing nothing about.

Ownership - that this is one person’s project or initiative, rather than that of a committee or “the company”.

When you realize there’s no demand in a particular call, good! Look for calls where there is demand, and compare + contrast with the ones that had no demand to figure out why.

And if you’re not seeing demand in any of your calls… good! Don’t waste your life pretending there’s demand where there isn’t. It is harder to build a small company around weak PULL than it is to build a big company around strong PULL!

When you don’t know what demand is, it usually means you need to go unearth a new PULL hypothesis. I recommend doing this by finding a potential customer, doing their job with them in-person, seeing where they are applying force against their status quo but struggling, and offering them supply for their demand to see if they bite.

2 - “There’s lukewarm demand / demand but no PULL”

This is when potential customers buy slow because they have little urgency, and/or you have low win rates because customers’ existing options are good enough. This is the most dangerous place to find yourself because you have enough positive signal to stay optimistic - but not enough PULL to stay alive. You can wind up here in limbo for months or years.

In this situation, you either need to change your Ideal Client Profile (ICP) to focus on who would be weird NOT to buy, or come up with a new attack vector for your existing ICP.

An example: For Waffle v1, we sold a devtool that builds AWS infrastructure that is SOC 2 compliant. While we sold and onboarded customers, we found two problems when we ran our demand audit:

“Get SOC 2 compliant” is a project that usually happens at a different time than “build our app’s AWS infrastructure”. As a result, we had people showing up who had built their existing infrastructure and didn’t want to change it; even if they were on some janky infrastructure, they didn’t really care - they just needed to get their SOC 2 report and check the box.

If we were to prioritize a more general “build my AWS infrastructure” project, there were plenty of existing options to build infrastructure that were perceived as difficult and frustrating, but our v1 product wasn’t perceived as significantly better on the vectors that mattered.

Instead of slogging along with lukewarm demand, we went back to the drawing board and iterated on a new PULL hypothesis by selling. Based on that, we’ve found some pretty interesting demand and are near releasing Waffle V2 - which lets engineers vibe code serious production infrastructure. More soon!

Execution Problems

3 - “We’re not talking to enough potential customers.”

This often seems like a demand problem, but it’s not! You haven’t earned a demand problem if you’re not talking to any potential customers! You just have a pipeline problem.

Ask yourself: Are you really trying? Or are you just spraying and praying Apollo sequences, putting very little thought into it, and going back to your happy place building product?

If you ARE trying to build pipeline and it’s just not working, here’s what to do:

If you are post-PMF and struggling to scale pipeline, consider a toll booth

Solve pipeline; earn your demand problem.

4 - “There was a demand signal… I just didn’t catch it or double-click into it”

About half the time I watch a sales call, there’s a demand signal somewhere - maybe in the customer’s intro, maybe hidden at minute 27 in what seems like a throwaway comment - that the founder never noticed.

When you hear the buyer mention they have demand, you have to STOP and fill out the PULL framework with them. (The whole point of the “Discovery” part of a sales call is to fill out the PULL framework with the potential customer!) If you miss this, you have an incomplete PULL framework, and you don’t really understand their demand or why they have it.

When you do a demand audit, you need to go back to that potential / actual customer and interview them to fill out their PULL framework. Even if they eventually didn’t buy from you, or they bought then churned, you need to have a full picture of their PULL at that moment to know what to do about it.

5 - “Their demand was pretty clear… but I’m not pitching anything that fits their demand”

When you rewatch one of your recorded sales calls, fill out the PULL framework to determine what the customer is trying to accomplish. Then watch your pitch and demo and ask: “Given their PULL, does what I’m pitching fit?”

The answer is almost always: “No, it’s like I’m on an entirely different planet.” It is safe to assume your pitch and demo is 90%+ wasted time.

Your pitch and demo should be:

Exactly what fits this potential customer’s PULL

…and nothing more!

When you do a demand audit, you’ll find simpler ways to describe and demo your - even sometimes repositioning and repackaging it - with the ultimate goal that potential customers who have PULL buy ~100% of the time.

6 - “There was demand/supply fit… and then there wasn’t.”

Often, deals quickly go from hot to cold. Maybe it’s in your first call, where they’re all in, but then they ask a few questions or raise a few objections and then ghost you. Maybe it’s after a group demo. Or maybe you have a second call that seems productive… and then you hear back that they’ll circle back sometime next year.

These are signals that your sales process might be the problem, rather than demand. A friend’s startup, for example, found demand, but then their champions kept getting wrecked by their CFOs when asking for budget. This caused multiple promising deals to die; is this a demand problem? Probably not - it seems like a “we need to help our champion not get wrecked by their CFO” problem.

7 - “This person bought from us fast because of X, where everybody else is coming to us because of Y.”

What you’ll tend to see at a growing Seed - Series B+ startup:

Some customers buy super fast and are satisfied

Some buy super slow and aren’t very happy

It is unclear why some are in Group 1 and others are in Group 2, or what to do about it

And this is breaking everything. Sales has a bunch of deals it’s wasting time and effort on; product is getting an unintelligible constellation of feature requests; customer success gets beaten up daily and isn’t sure what to do about it.

When you look into this kind of company’s sales calls, and compare + contrast the PULL framework for good customers vs. bad customers, you will find meaningful differences. The buyers who buy fast have something different on their to-do list; or they are in a different situation from those who buy slow; or something - that causes them to exert force in a way and direction the others don’t. By focusing exclusively on the customers with a certain shape of PULL, you narrow your targeting and focus your energy on your best-fit customers.

So what?

Do a demand audit. Fix what it uncovers. Repeat.

PS:

My next live “product-market fit + sales” program is launching in November (I have been running private versions for funds like Afore, Lightspeed, EIF Catalyst, etc.) Apply soon and learn more HERE.

I am also basically at capacity for 1:1 work, so if you’re interested in getting my support reviewing your sales calls + navigating 0-1 at some point in 2025, please apply soon HERE.

Just the clarification on WTF is demand has reshaped my thinking. I had assumed systemic change is 'wanted' but it really probably isn't. It needs to come from individuals. Thanks so much for sharing just that!