The PULL Framework, In Detail

Developing your intuition for PULL

Listen:

PULL is, I believe, the most important concept in startups and business. It is the hidden load-bearing wall that explains why some products take off but others don’t, why customers really buy things, and what is the “shape” of a new thing is needed in the market.

I want to give you more of an intuition for the PULL framework as I currently understand it.

There are, of course, four elements of the PULL framework:

There is the project on a potential customer’s to-do list, which is being prioritized now.

There is a reason the project is urgent or unavoidable now, versus all the other projects they could prioritize on their to-do list’s infinite backlog. They are in some sort of situation where they would be weird if they didn’t prioritize this project!

They consider a list of options for accomplishing this project they’ve prioritized. These options are not just our direct competitors - they might be technologies, hiring, or a variety of other things.

But, the options they consider have severe limitations that prevent the potential customer from making the kind of progress they’re trying to make.

I’ve found I need to describe PULL from a few different directions to build your intuition for it.

The base assumption

Let’s start with a base assumption about people: They don’t care about us. They don’t care about our product, how we want the world to work, and they really don’t want us to try to convince them they should care about these things.

In other words: The default state is total indifference to us. This is most people, most of the time.

People care, by default, about themselves. They have jobs to do, things to do in their lives. Sometimes, sometimes, we “fit” what they’re trying to do in their lives - this is when they are not indifferent to us.

PULL represents a state in which a person is not indifferent to us - more than that, it represents when they would be weird not to buy our product.

PULL as “blocked demand”

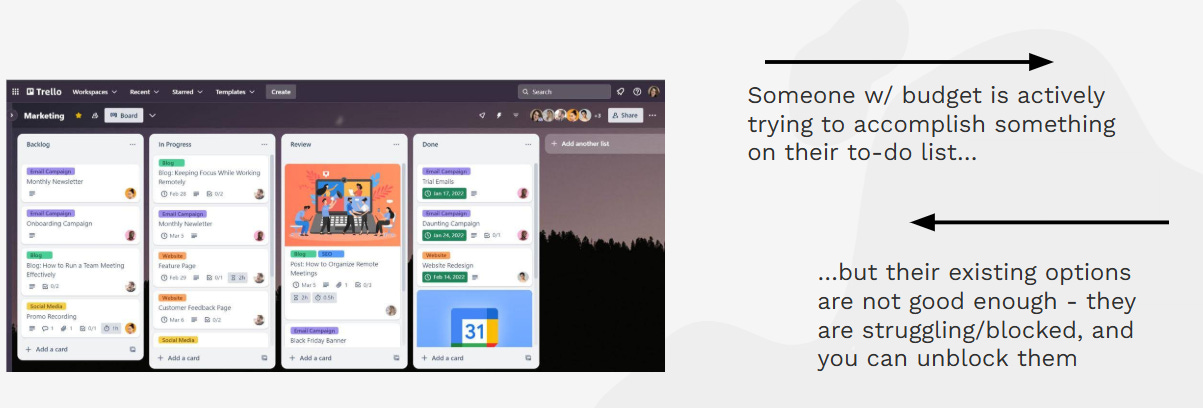

An easy place to start building your intuition for PULL is by combining P&U, and combining L&L.

There is a person who is applying force against their status quo, trying to accomplish something (P + U)…

But their existing options aren’t good enough (L + L) and are pushing in favor of their status quo.

Simply: An unavoidable project meets unworkable options.

A person in this situation would be weird NOT to buy our product; everyone else would be weird to buy our product given their priorities & options.

Note that P+U are demand, while L+L are supply options that are blocking demand. PULL is a state of blocked demand.

PULL versus “problems” and “pain points”

You could, of course, define this state of blocked demand as a “problem”, and you could define the bad-fit supply options as “pain points.”

But most things we’d call “problems” are NOT this state of blocked demand - they are random, abstract things like “climate change” (certainly a problem, but not obviously demand). And the inverse: Most things we try to take action on with blocked demand are not “problems”. (E.g., If I am buying you a gift, there is no “problem.”) The same is true with pain points: Many things are pain points, many things are “hair on fire” pain points, and yet we mostly just live with them.

I define PULL in a very specific way (and avoid using the terms “problems” and “pain points”) so you don’t wind up in the awkward situation where you’ve found “big problems and pain points”… and then waste years building something nobody actually buys. The Venn Diagram of Suffering explains why so many startups fail to “build something people want”:

Instead, when you use the PULL framework, you define a target customer who would be weird not to buy your product because they are in a state of blocked demand. Anybody else could buy your product, of course, just like you theoretically could predict every remaining word of this post. Not impossible, but highly unlikely.

PULL is not “desire for supply”

YC’s motto is “make something people want” - which sounds right at first glance, but then you ask yourself: Has anyone ever wanted an ERP? A CRM? A data-driven visualization tool?

Of course not. People have been committed to psychiatric treatment for lesser things.

But… these products are wildly successful. There is even a conference called Dreamforce that adults attend - seemingly of their own volition!

This paradox only makes sense when you realize that demand is not “desire for a product”.

To understand this, we have to separate demand and supply: Supply is what we build; demand is what a person is trying to achieve in their life.

Demand is supply-agnostic. Nobody’s demand is to “buy a CRM”, because that is about supply. Demand would be something like “organize my sales team’s data so I can manage and forecast effectively” - a CRM is one of the categories of options I consider on the supply side in order to fulfill this demand.

When what’s on the demand side is strong enough - they have an urgent project with bad-fit options - people will behave as if they want your product. They will rip it out of your hands, they will thank you for it when it’s a janky MVP, they will attend your user conference, etc.

What causes PULL?

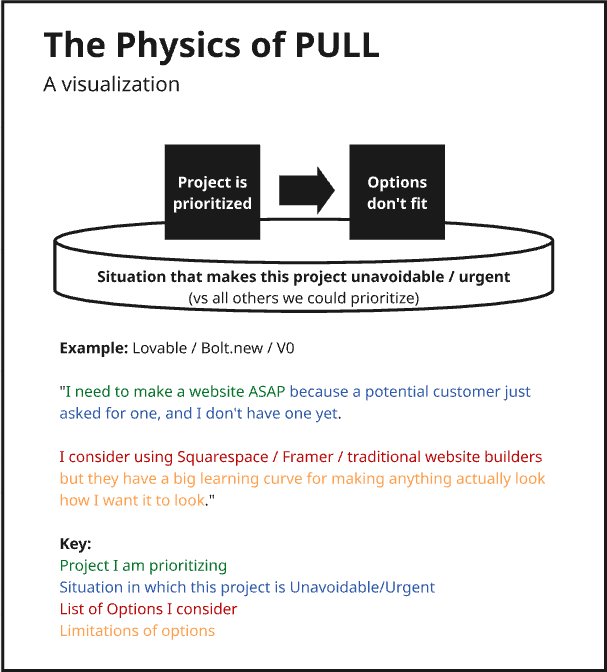

Underneath PULL is the situation in which a specific project is made urgent or unavoidable. The situation forces a buyer to prioritize one specific project over all the others they could prioritize right now. (And then, they get blocked by their existing options.)

Basically, a person’s situation shapes their to-do list. While many people could be prioritizing a project right now, we want to focus on the situations that make it weird for someone not to be prioritizing a specific project right now.

PULL defines the “shape” for supply

We can see below the lifecycle of a project: how it moves from someone’s backlog to their #1 priority, how it gets shaped into something more detailed, and how their bad-fit options create a specific, defined space your product needs to “fit” in order for it to be pulled.

Note that PULL also defines smaller things on the supply side, like:

The pricing buyers expect

The onboarding experience buyers expect

What they need to accomplish in order to renew

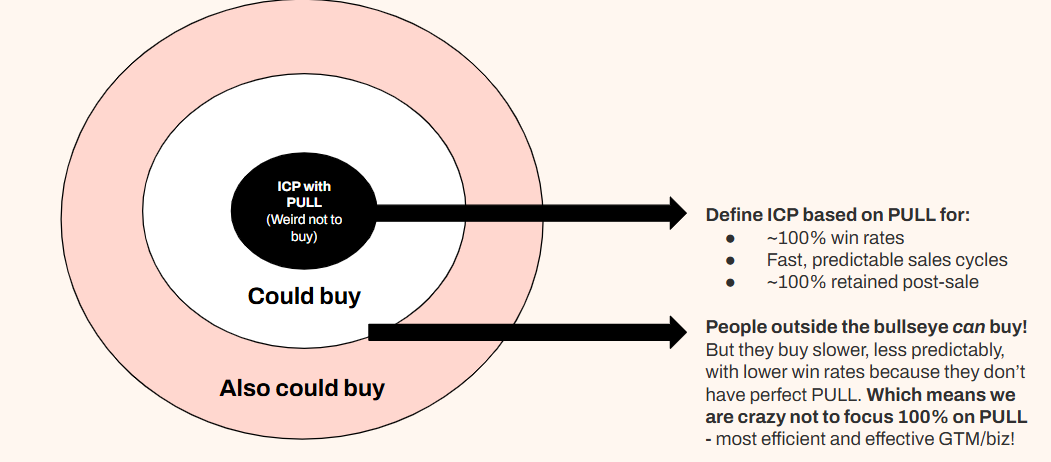

Who has PULL = Your ICP

When we’ve defined PULL correctly, we’ve defined someone who would be weird not to buy. Everybody else would be weird to buy our product - they are prioritizing some different project on their to-do list, or their existing options are good enough!

People with PULL are the center of our bullseye: They buy without convincing, as our product unblocks them from what they are currently prioritizing. They should have ~100% closed-won rates, ~100% success post-sale, and fast sales cycles where they exert most of the effort to get the deal done:

Yes, people outside the bullseye can buy… but we have to do more convincing and pushing for a lower conversion rate, lower post-sale success rate, and a slower decision process. They often have random feature requests and don’t “see the value” that those with PULL see.

Focusing on anyone other than those with PULL is just opportunity cost.

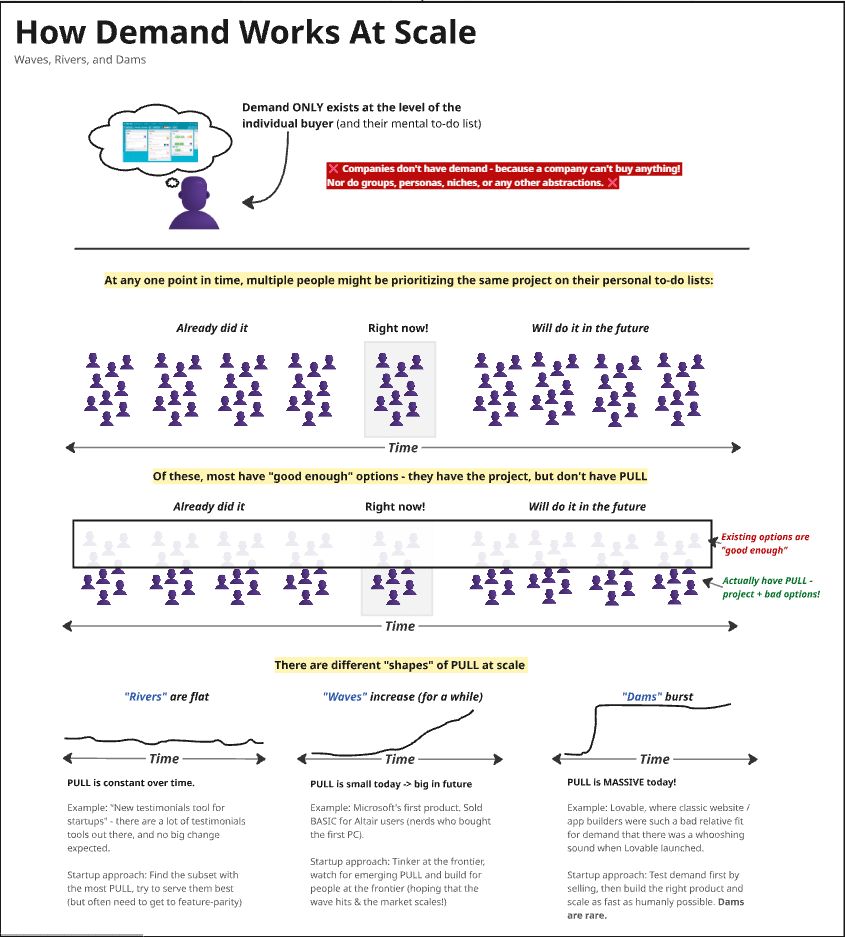

PULL defines your market

We look at PULL at the level of one individual customer, then figure out the ICP based on that, and can zoom out to see the “shape” of our current market based on who will PULL at t=now.

I have previously written about Rivers, Waves, and Dams to explore “shapes” of zoomed-out PULL that lead to fast-growing startups. I am still exploring this concept.

See the full graphic and zoom in on the Physics of Startups Miro board.

Even sales calls should be designed around PULL

I have found that most sales calls are wandering dumpster fires; we ask a set of questions following some sales framework, not quite knowing exactly what we’re looking for. The potential customer goes on a long and wandering monologue about their situation and goals, which is confusing and disorienting to us, so we just say, “well thanks for that, here’s our product, do you want it?” and proceed to drag them through an awful presentation and never-ending demo.

When you understand PULL, sales calls become intuitive and easy. In a sales call, “discovery” is about filling out the potential customer’s PULL framework. This is the core thing to understand their “need” and shape how we describe/demo our product.

A sales call, roughly, goes:

Fill out their PULL framework

Offer something that fits their PULL framework - nothing more, nothing less. No fancy demos or vision-casting BS needed.

See what happens (they should pull!)

Example PULL writeup

I have been trying to articulate founders’ PULL when they ask me to advise them. Here’s my rough draft:

Note a few things here:

The situation is the real underlying driver: Something is happening in their world that is causing them to think something like, “We should be further along; we should be moving faster.”

The project is relatively abstract. Compare it with something like Fletch that’s way more concrete - “Fix your confusing website messaging.” If I were trying to build a more productized business, I would almost make mine concrete to something like, “Fix your sales calls that aren’t converting.”

I have shaped the whole thing to be coherent. The reason, for example, I articulate many things in the “project” ($1M+ ARR, repeatable sales, PMF, insanely fast growth) is to “fit” with the limitations of a traditional sales coach, who founders perceive as not understanding the complexity of 0-1; not “getting” the product side. The reason I use the terms “get unstuck + move faster” in the project is to select for people who aren’t thinking of DIY.

I have found that there are infinite permutations of PULL I could write, a vast subset of which would create viable businesses. A small subset of examples I could consider:

More concrete, about “fixing sales calls” or “scheduling sales calls”

More abstract, purely about “product-market fit”

Some approach where people who aren’t suffering in the pain cave still pull me in (e.g., “do what the fastest-moving startups do”)

More aspirational, like “finally make dad proud”

I call these different permutations “attack vectors”; each attack vector generates a different ICP, ideal-fit supply-shape, and business as a result. There is almost certainly an efficient frontier for attack vectors, and probably even some sort of global optimum.

Choosing your specific attack vector from the infinite possibility space is a monstrously complex task. I have been thinking about this for nearly a year, and I can confidently say I am somewhere between 3 months and 3 decades away from having a satisfying answer. (Please provide any and all resources you suggest I should consume for this!)

PS: Learn how I advise startups HERE. Startups are now reserving me for Q1, so reach out soon!

You write that PULL also defines the pricing, onboarding, success, etc. that buyers expect. Could you expand on that sometime?

Regarding

```

Choosing your specific attack vector from the infinite possibility space is a monstrously complex task. I have been thinking about this for nearly a year, and I can confidently say I am somewhere between 3 months and 3 decades away from having a satisfying answer. (Please provide any and all resources you suggest I should consume for this!)

```

I highly recommend Anthony Pierri and his talks on positioning angles for startups:

- https://www.youtube.com/watch?v=xQmP1LZ5bXs

- https://www.youtube.com/watch?v=oICXfZg68x0